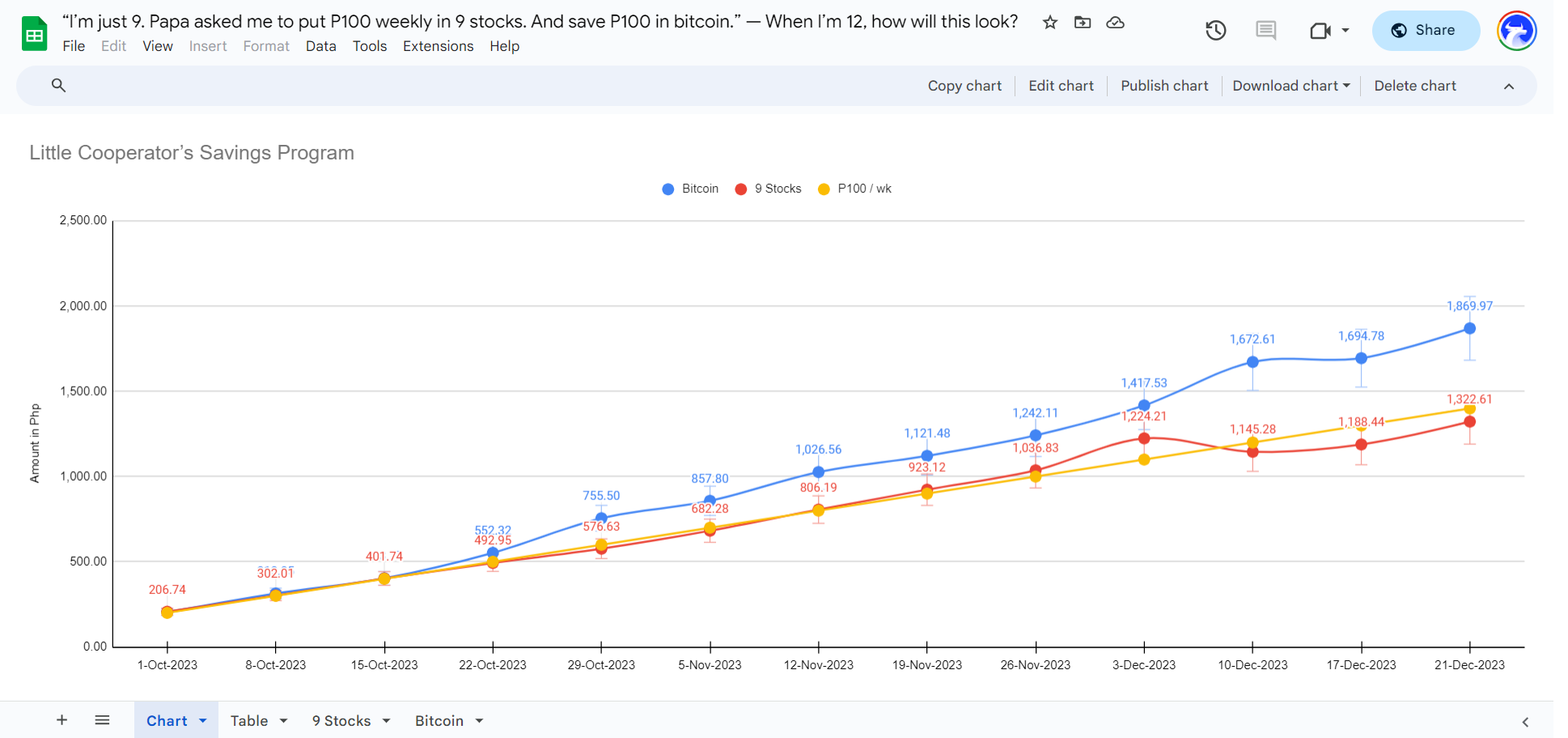

This little experiment seeks to answer the question, “If I put 💸 100 pesos weekly in nine stocks, and if I also save 💰 100 pesos in bitcoin, what will happen?” 🤔

This is an application of the popular stock market investing approach called “dollar cost averaging” or DCA. Since we are Filipinos, let’s call this peso cost averaging. 💵💼

Peso cost averaging is a smart way to invest money over time. Let me break it down for you: 📉📈

Imagine you have some money, and you want to invest it in, let's say, the stock market. Instead of putting all your money in at once, you decide to invest a fixed amount regularly, let's say every week, or month. 🔄💰

This means you're buying a certain number of shares with the same amount of money each time. 📊🔄

Now, because the stock market goes up and down, the price of the shares will also vary. When the price is high, your fixed amount of money will buy fewer shares. When the price is low, your fixed amount will buy more shares. 📈📉

Here's the magic:

Over time, these ups and downs tend to balance out. Sometimes you buy when prices are high, sometimes when they're low. This helps reduce the impact of short-term market fluctuations on your overall investment. ✨🌈

So, by consistently investing a fixed amount at regular intervals, you end up with an average cost for all the shares you've bought. This strategy is like taking small, measured steps instead of one big leap, and it helps smooth out the effects of market volatility. 🚶♂️🚶♀️💖

The best way to peso cost averaging and save a little in bitcoin is, of course:

This idea was inspired by Law Dean and former Solicitor General Florin Hilbay who has a beautiful program but we are not sure we can say it out loud at this point.