Cooperatives that integrate Bitcoin in their treasuries, meaning those who save some of their monies in bitcoin, will gain a significant advantage over companies that rely solely on traditional fiat currencies. Let’s explore the reasons why a Bitcoin-first cooperative could outperform its counterparts, focusing on financial resilience, innovation, and market positioning.

Who can do this first, a primary cooperative? Or a federation?

Crack the brain first

Forget about the technology aspect of this. Let’s just crack the outermost layer of the brain first:

The use of a currency other than the peso (PHP) is not as mind-boggling as it seems. Many Filipinos already keep dollars (USD), e.g. dollar savings account in local bank like BDO. Say you got home from travel, where you prepared dollars before going. Or, you exchanged pesos for dollars in your destination. Then when you went home with your family you still have dollars with you.

Expecting to travel again, therefore the need for dollars again, you decide to just open a dollar account with BDO. Instinctively, if you are a moderately-read person, you also want to keep some of your money in USD because:

The peso has been falling in value against the dollar over time. Then that purchasing power of the dollar has been falling over time.

It is a double whammy

Now that the brain has been cracked a little, how is this relevant to my cooperative, your cooperative? In the same way it is relevant to just about anyone and everyone who uses money.

Financial Resilience

Bitcoin's unique attributes, such as its limited supply and decentralized nature, can enhance a cooperative's financial resilience. Unlike fiat currencies, which can be subject to inflation and devaluation, Bitcoin has a cap of 21 million coins, making it inherently deflationary. This scarcity can protect a cooperative's assets from erosion of value over time, particularly in inflationary economies.

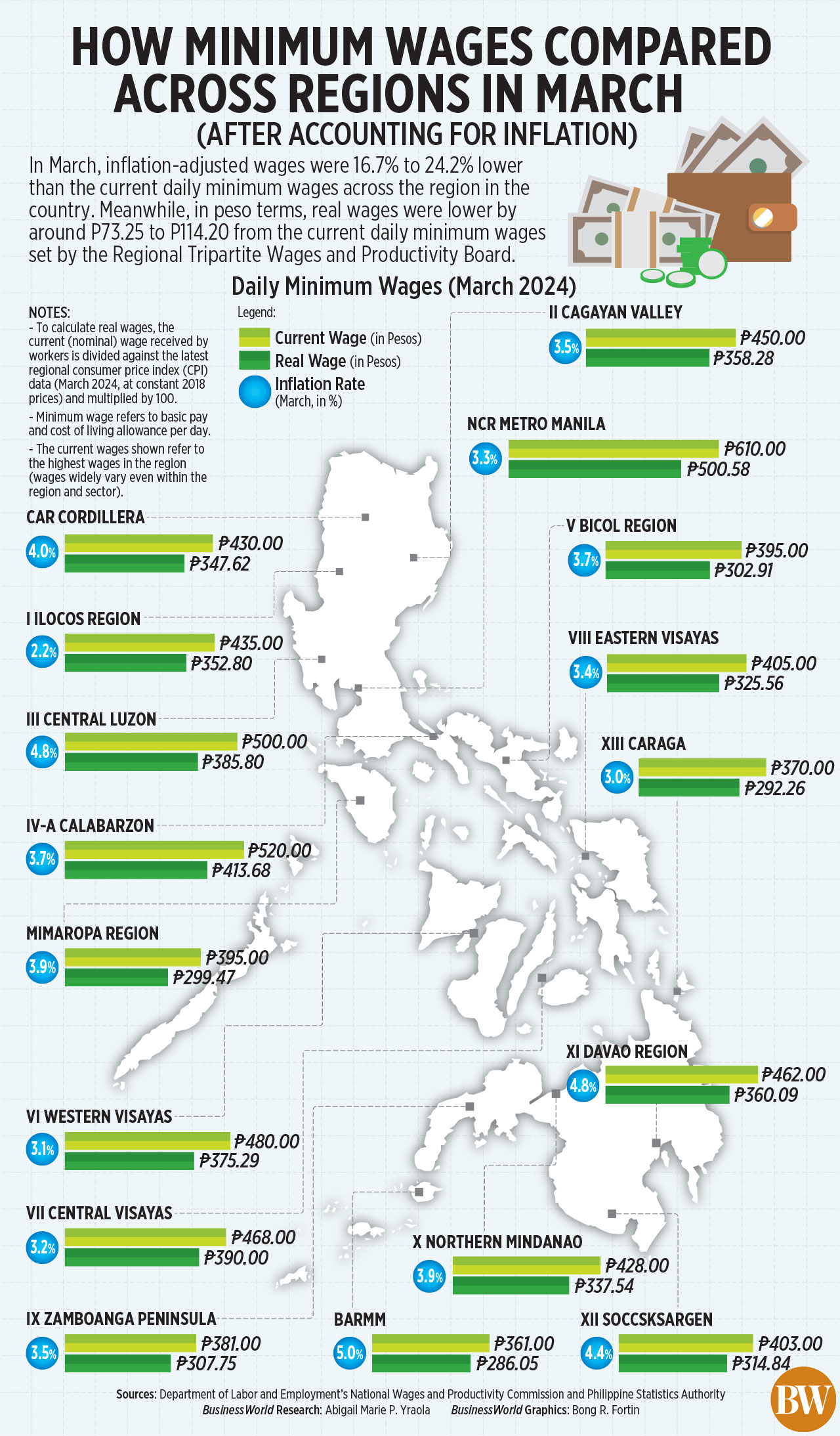

Former Solicitor General Florin T. Hilbay, responding to a news report that inflation in the Philippines has quickened to 3.7 percent this March 2024 said,

“Don’t look simply at inflation as the rate of increase of prices of goods/services. it’s important to view inflation as the rate of decay of your currency, the creeping death of the value of your labor. Maybe then, you’ll begin to understand the solution to this man-made problem.”

Hilbay, who wrote the Philippines’s seminal book on bitcoin (this is out of stick in The Co-operative Exchange, but you can buy this in his website but then know what there’s already a new edition out that you can buy from Amazon), further wrote,

“The persistent loss of value of every currency, the peso included, is a consequence of money printing, unsustainable debt, deficit spending, and oversized government. It’s the reason why governments have an “inflation target,” a euphemism for monetary debasement. It’s baked into the system,” commenting on BusinessWorld report (April 8) on minimum wages,

“Rate of decay of your currency”

Market Positioning and Member Benefits

A cooperative with Bitcoin in its treasury can offer unique value propositions to its members. In periods of economic downturn or financial instability, Bitcoin has often been viewed as a “safe haven” asset, similar to gold. This perception can enhance the cooperative’s appeal, especially for members seeking to diversify their assets and reduce exposure to traditional financial systems.

One country faces lifestyle changes due to inflation, insolvency, a banking crisis, and perpetual war.

— Jack Mallers (@jackmallers) April 8, 2024

Another country is ascending by pursuing the hardest money, low crime, beautiful aesthetics, and entrepreneurial talent.

Which is the US, and which is El Salvador?#Bitcoin https://t.co/cJRfNzl3Je pic.twitter.com/0lUNVkOcGh

As Bitcoin gains mainstream acceptance, cooperatives that have already integrated it into their operations will be ahead of the curve. They can capture early-mover advantages, such as establishing relationships with other bitcoin-friendly businesses, accessing new markets, and participating in the growing digital economy.

Enhanced Liquidity and Investment Opportunities

Bitcoin’s liquidity and 24/7 market availability ensure that cooperatives can access funds or make investments at any time, without the limitations of traditional banking hours or processes.

While the integration of Bitcoin comes with its own set of challenges and risks, such as price volatility and regulatory considerations, the strategic management of these factors can lead to superior performance and sustainable growth.

> mainstream media news anchor upset because Michael Saylor won’t say he’ll sell bitcoin

— Nik (@nikcantmine) March 12, 2024

> Gigachad explains to her: “people who use fiat currency as a store of value, there’s a name of them, we call them poor”

☠️😂 pic.twitter.com/dXJWsc3MlF

“Death of value of your labor”

Innovation and Adaptability

Adopting Bitcoin can position a cooperative at the forefront of financial innovation, attracting members who are interested in cutting-edge technologies. This can lead to a more dynamic and adaptable business model, capable of leveraging bitcoin for more than just financial transactions.

New in v0.3.72

— Timechain Calendar (@TimechainCaL) April 8, 2024

Reduced animation setting now turns off the halving circle pulse. The pulsing will only get more intense as we approach the halving so the ability to disable it is now available!

✅Settings > Display > Reduce Animation pic.twitter.com/DKkAReFrWT

Moreover, the transparency and traceability of Bitcoin transactions can improve a cooperative’s accountability and member trust. Every transaction is recorded on the blockchain, providing a clear and tamper-proof ledger of financial activities.

Real and Instant Global Reach

Bitcoin's global reach and lack of affiliation with any single nation-state or financial institution can mitigate geopolitical and currency risks. For cooperatives with international operations or supply chains, Bitcoin can serve as a hedge against currency fluctuations and capital controls.

To close, a video by Strike, a US-based Lightning wallet that Filipinos can use within the Philippines and to send to and from relatives in the US.

Learn More

Best-selling bitcoin books in Amazon.com

The Lightning Network is the best tool for financial inclusion for co-operatives in the Philippines and around the world. Lightning is the fastest and cheapest way to send bitcoin to any part of the globe. CoopPay can serve millions of cooperative members in the Philippines. CoopPay seamlessly integrates the national QR code standard (QR Ph) and Lightning, making it a game-changer for transactions within co-operatives and global collaboration.

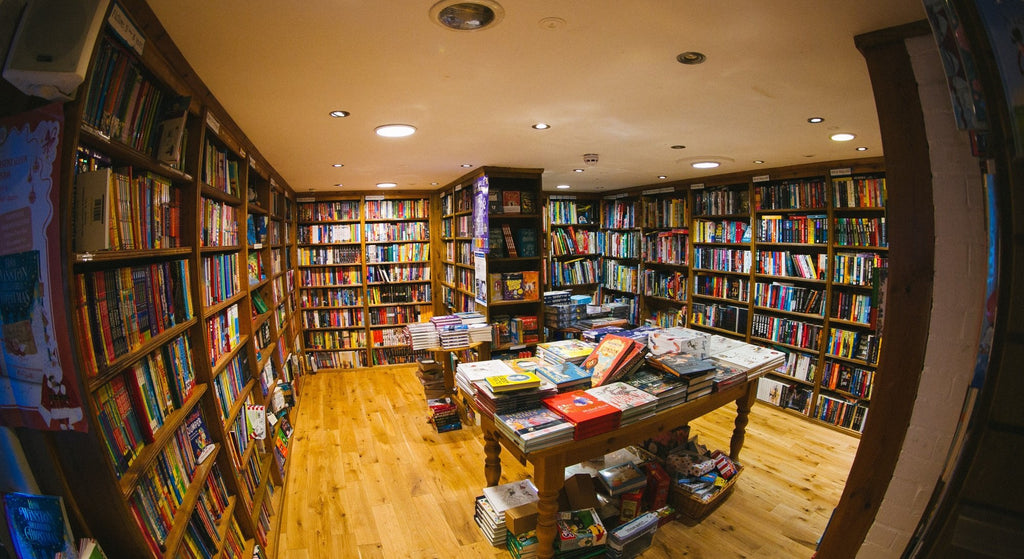

Coop Bookshop

Ask your Education and Training Committee to fill your co-operative bookshelf with us! Whether you’re a member of your board, director, CEO, VP or just starting out in your co-op journey, keep curious, keep discovering, so you may keep inventing. We work with the leading book publishers in the world and we carry books aligned with our ethos of self-help, self-sovereignty, and self-learning.

Support this project by using your CoopPay (or any Lightning wallet) to send pesos or satoshis to any of the following Lightning Addresses! coop@pouch.ph (CoopPay wallet), lightningcoop@blink.sv (Blink wallet), and coop@coinos.io (Coinos wallet).

Thank you!

Advertising

Where appropriate, we recommend books for study. As part of Amazon Associates, an advertising program for sites to earn advertising fees by linking to Amazon.com, we recommend books aligned with our ethos of self-help, self-sovereignty, and self-learning. We may earn ad fees for purchases made through our links, with no cost to you. Thank you!